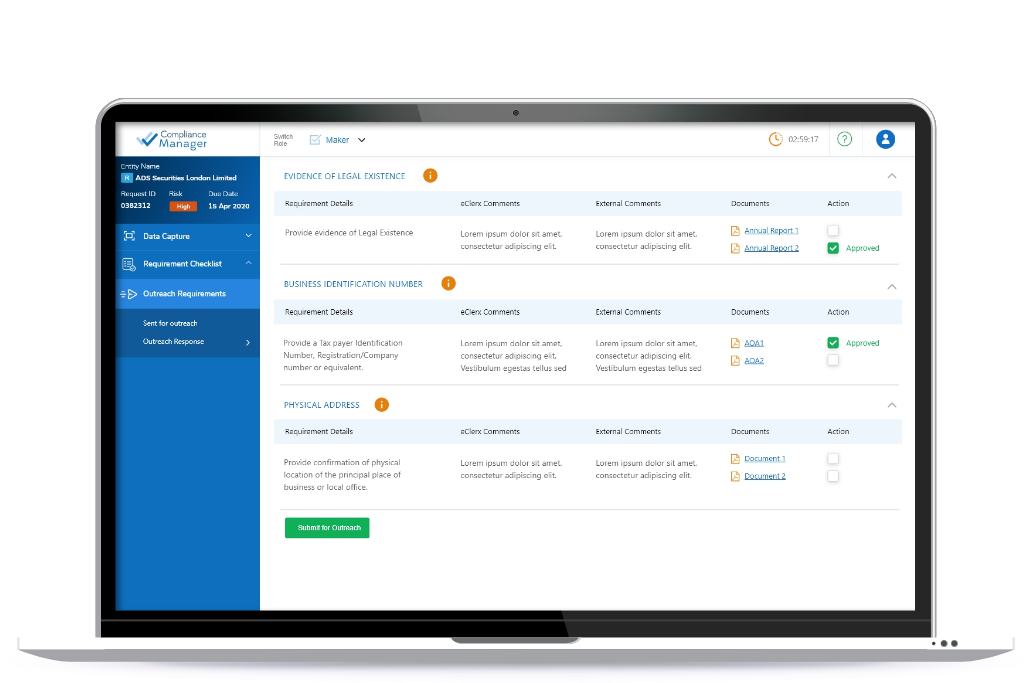

With Compliance Manager, you get

-

Data Capture

The data capture workflow enforces capture of complete information about the client based on the risk category and type of entity, wrapped in maker-checker workflow.

-

Data Search

Configure business rules across jurisdictions to determine CDD/ EDD requirements.

-

News Analysis

NLP is used for classification of the results into positive / negative, based on the underlying keyword result set used for Semantic analysis.

-

System Interfaces

API for upstream / downstream systems integration. Trigger reviews where information is not available with compliance / COB teams.

-

Reports

Customize, view and download risk, business, cost and audit reports.

SOLUTIONS

Integrates with existing client technology. Integrated workflow for allocation , re-allocation, review and audit.

Data harvesting from public sources using robotics and third party API’.

Repository to retrieve client entity names and gather existing KYC history.

Customizable region specific attribute list based on risk classification.

SCREENING

Inbuilt cognitive intelligence for adverse media screening and multiple source led errors.