-

Document Management

Providing actionable insights from paper documents

-

Analytics

Make the most of your data assets to yield enhanced customer relationships

-

Regulatory compliance & Data Management

Delivering scalable and cost-effective solutions for regulatory compliance and data management initiatives

-

Document Management

Providing actionable insights from paper documents

-

Analytics

Make the most of your data assets to yield enhanced customer relationships

-

Regulatory compliance & Data Management

Delivering scalable and cost-effective solutions for regulatory compliance and data management initiatives

With Loan Manager, you get

-

Flexibility

Functionality to create rules to extract information from source documents.

-

Automation

Optical character recognition converts scanned images to text via automated extraction and capture by selection a part of the image.

-

Intelligent Search

Perform intelligent search on OCR'ed documents with a feature to highlight searched text in the result docs.

-

Dashboards

Operational Metrics for better control and governance. Drill through reports are available to perform various analysis and track SLAs.

SOLUTIONS

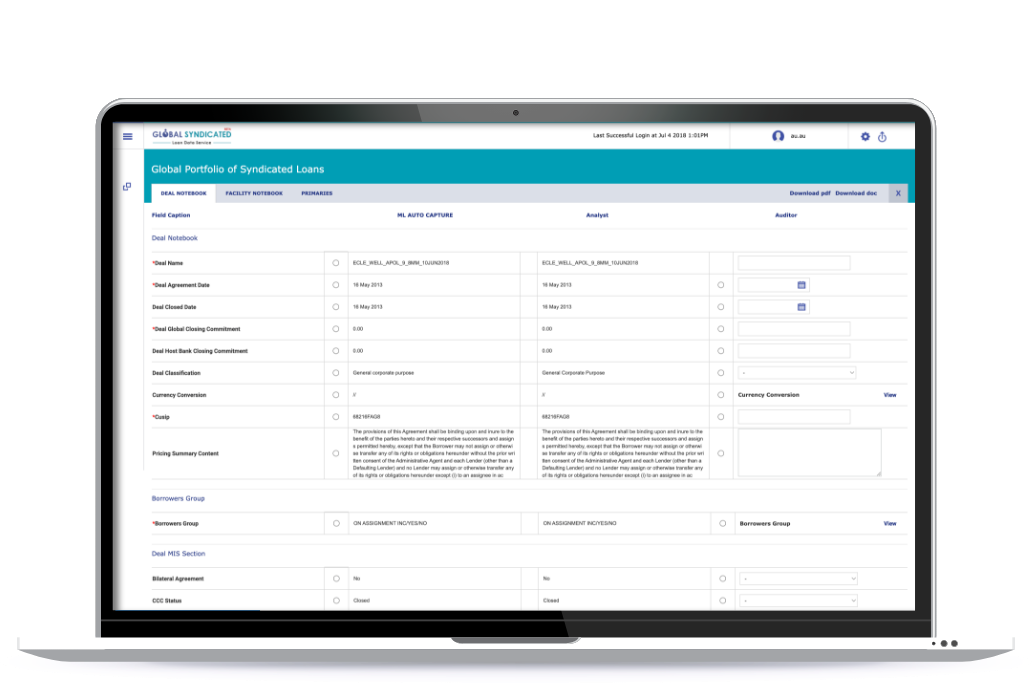

eClerx to capture the Syndicate deal data once - using Public to Syndicate Docs from customers.

Loan Deal data digitized using Machine Learning Model on platform - to be available for customers to review / consume within agreed SLAs.

Mutualisation benefit to reduce deal creation time by 80% for multi-customer deals.

Control - Public to syndicate data fields agreed during setup for smooth transfer post digitization to market.

Utility model to lead to significant drop in settlement timelines for Industry.