Introduction

In an ever-evolving regulatory landscape, a USA-based investment group faced the formidable challenge of enhancing its Client Lifecycle Management (CLM) processes. Striving to meet compliance requirements while ensuring a seamless client onboarding experience, they turned to eClerx Compliance Manager, a strategic technological solution. This case study delves into the remarkable journey of this transformation and the key milestones achieved across four phases.

Client

A USA-based investment group.

Challenge

The client needed to enhance client onboarding, streamline Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, improve document enrichment, and ensure secure client interactions. They required a robust solution to meet regulatory demands and optimize operations while maintaining efficiency.

Solution

eClerx’s Compliance Manager, a comprehensive client lifecycle management platform designed to streamline compliance processes and improve operational efficiency, was implemented to address the client’s challenges. The transformation occurred across four key phases. Initially, the platform was deployed within six weeks, streamlining client onboarding and serving as the system of record for KYC data.

The scope was then expanded to include periodic reviews, integrating the platform into the client’s AML framework. Document digitization was facilitated using eClerx’s document management solution, DocIntel, enabling efficient handling of fund subscription and tax forms. Finally, a client-facing portal was introduced to provide seamless digital onboarding and fund subscription, significantly enhancing the client experience.

The solution also evolved the KYC workflow, improving every stage, from request initiation and document review to data gap analysis, client outreach, screening, risk analysis, and case data transfer.

Impact

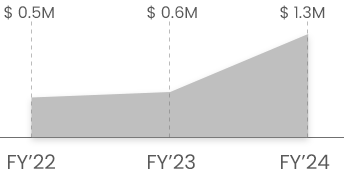

The implementation of eClerx Compliance Manager streamlined compliance processes and operational workflows. As a result, revenue projections increased from $0.5 million in FY’22 to $0.6 million in FY’23 and reached $1.3 million in FY’24.

By adopting eClerx Compliance Manager, the client achieved enhanced compliance, operational improvements, and significant revenue growth, positioning them for continued success in a challenging regulatory landscape.

Keywords:

Third party application integration

(Salesforce),

Document enrichment

[DocIntel web services],

Client facing portal

Third party application integration

(Salesforce),

Document enrichment

[DocIntel web services],

Client facing portal

KYC Workflow Evolution

The transformation included the following stages in the KYC workflow:

- Request Initiation

- Self-Sourcing

- Document Review

- Data Gap Analysis

- Investor/Client Outreach

- Screening

- Risk Analysis, QA Approvals, Signof

- Case Data Transfer

Results and Impact

The transformation yielded remarkable results:

Financial Growth: Total revenue projection grew

from $0.5 million in FY’22 to $0.6 million in FY’23

and to an impressive $1.3 million in FY’24.

Financial Growth: Total revenue projection grew

from $0.5 million in FY’22 to $0.6 million in FY’23

and to an impressive $1.3 million in FY’24.

Future Outlook

As the industry continues to face new challenges and regulatory changes, the organization is poised to stay ahead with eClerx Compliance Manager, shaping a future where compliance is seamless, efficient, and customer-centric.

Conclusion

The successful implementation of eClerx Compliance Manager not only enhanced compliance and KYC processes but also unlocked substantial revenue growth for the investment group. With a forward-looking approach, they are well-prepared to navigate the evolving landscape of Client Lifecycle Management and Anti-Money Laundering.